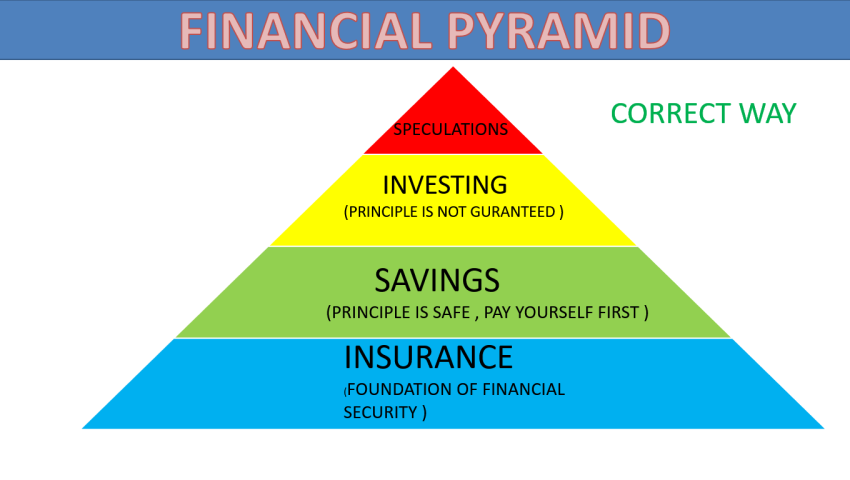

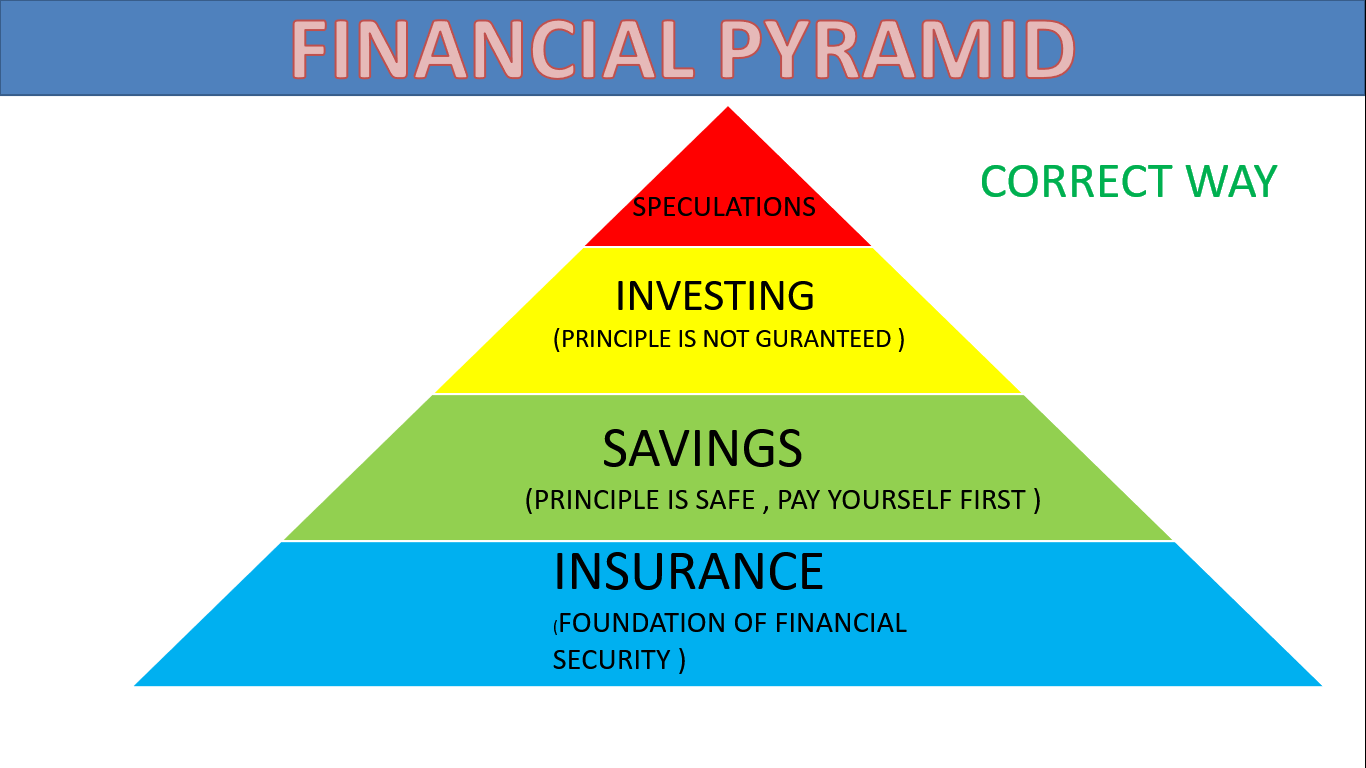

FINANCIAL PYRAMID CORRECT POSSISON

FINANCIAL PYRAMID IN THE CORRECT WAY

The financial pyramid concept is a framework in personal finance that prioritizes different types of financial goals and needs according to their importance and stability. It helps individuals build a stable financial foundation before taking on riskier or more speculative investments. Typically, the pyramid is divided into several layers, with each level representing a specific type of financial priority:

1. Foundation Layer: Protection and Security

- Emergency Fund: At the base of the pyramid, the primary focus is building an emergency fund, usually covering 3-6 months of essential living expenses.

- Insurance: This includes health, life, disability, and property insurance to protect against unforeseen events.

- Debt Management: Ensuring any high-interest debts are paid down to avoid financial strain.

- This foundation layer is designed to provide financial security and stability, acting as a buffer against unexpected expenses.

2. Savings and Income Layer

- This layer focuses on stable, low-risk savings and income-generating investments.

- Retirement Savings: Contributing to retirement accounts (e.g., 401(k), IRA) to build long-term security.

- Fixed-Income Investments: Bonds and other low-risk, income-producing assets fall here, as they offer stability with modest returns.

- The goal is to create a reliable income stream, focusing on safety and long-term growth.

3. Growth Layer

- Once financial security and income are in place, the next layer emphasizes moderate to higher-growth investments.

- Stocks and Mutual Funds: Higher-risk investments that offer potential growth but come with volatility.

- Real Estate Investments: Owning property or investing in real estate funds, which can provide capital appreciation and rental income.

- This layer aims for wealth accumulation, balancing growth with moderate risk.

4. Speculative Layer

- The top of the pyramid, reserved for high-risk, high-return investments.

- Individual Stock Picking, Cryptocurrencies, Options, and Other Speculative Assets: These are high-volatility investments that could yield significant returns but also carry a high risk of loss.

- Only a small portion of one's assets should be allocated here, and only after securing the lower levels of the pyramid.

Summary

The financial pyramid concept encourages a step-by-step approach to financial stability, focusing on security and risk management before moving into more speculative, high-return investments. It serves as a guideline for building a balanced, resilient financial plan based on individual risk tolerance and financial goals.

K S Babu Associates

Leave a comment

Your email address will not be published. Required fields are marked *